Understanding Financing Options for SMEs: Discover Practical Solutions to Fuel Your Growth

Presented by the Institute of Certified Business Consultants (ICBC) Nigeria – June 2025 Lunch & Learn Series

Small and Medium Enterprises (SMEs) are at the heart of Nigeria’s economy, contributing over 90% of all businesses and approximately 48% to the country’s GDP. Yet, despite their importance, SMEs face a major challenge: limited access to funding.

This article explores the types of financing available, outlines common obstacles, and presents practical solutions for SMEs to secure sustainable funding and drive growth.

Key Takeaways

- SMEs make up over 90% of Nigerian businesses and need funding to survive and grow.

- Bank loans, equity, grants, and VCs are just a few financing options.

- Challenges like credit scores and documentation hinder access.

- Preparation is crucial – from CAC registration to business planning.

- Funding is most beneficial when aligned with business growth goals.

Why Business Financing Matters

- SMEs provide over 80% of employment in Nigeria.

- Access to finance enables expansion, innovation, and improved competitiveness.

- Lack of funding has forced many startups to shut down within their first few years.

- Reliable financing allows SMEs to invest in equipment, hire talent, and build sustainable operations.

Available Financing Options for SMEs

Here are the most common financing options for SMEs in Nigeria:

| Financing Option | Description & Advantages | Common Challenges |

|---|---|---|

| Traditional Bank Loans | Offered by commercial, Islamic, and microfinance banks. E.g., Access Bank, Stanbic IBTC. | High collateral, complex application, regulatory bottlenecks |

| Equity Financing | Gives investors ownership in your business. No repayment obligations. | Diluted ownership, possible misalignment of goals |

| Venture Capital | Funding in exchange for equity. Often supports startups with growth potential. | Involves due diligence, investor control, and exit terms |

| Angel Investors | High Net Worth Individuals offer funds and mentorship. | Terms vary, often relationship-dependent |

| Supplier Credit | Short-term credit (30–90 days) to improve cash flow. Often interest-free. | Depends on business trust and credit history |

| Crowdfunding | Raising funds from the public through online campaigns. | Requires digital marketing skills and social proof |

| Government/Development Grants | Grants from agencies like CBN, TEF, World Bank, GIZ, AfDB, and UNDP. | Competitive, requires thorough applications and documentation |

Examples of Funding Opportunities in Africa

- Tony Elumelu Foundation (TEF) – $5,000 seed capital plus mentorship

- African Development Bank (AfDB) – Youth innovation and entrepreneurship trust funds

- World Bank/IFC SME Programs – Ongoing support for small businesses

- GIZ (German Development Agency) – Digital skills, business grants, and advisory support

- UNDP and other UN agencies – Grant and accelerator programs for African SMEs

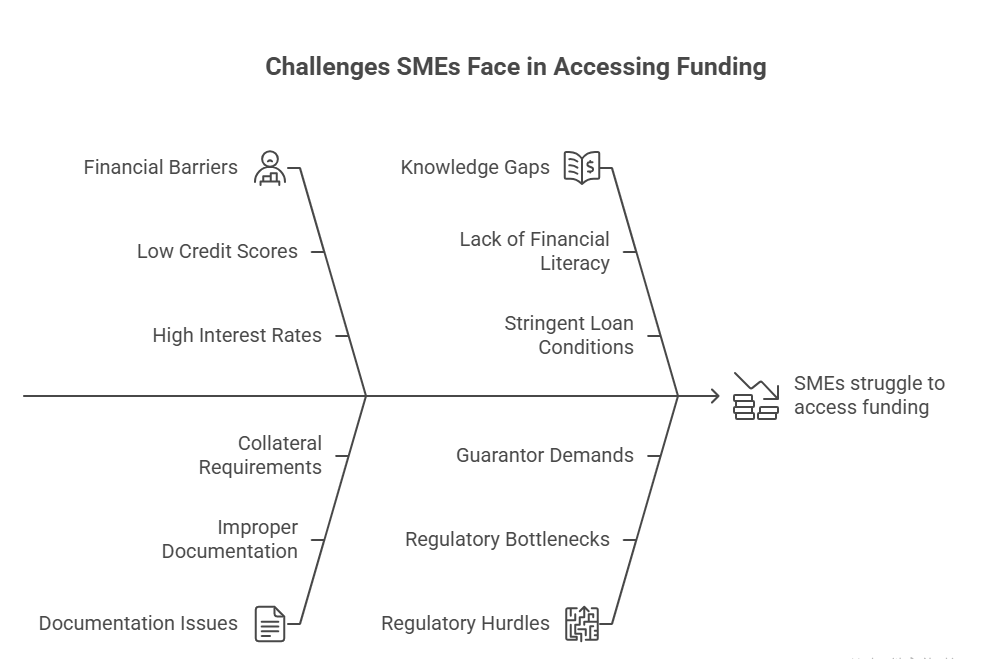

Key Challenges SMEs Face When Accessing Funding

- Limited access to capital

- High interest rates

- Short repayment windows

- Low credit scores

- Inadequate financial and business documentation

- Lack of awareness or understanding of available options

- Collateral and guarantor requirements

- Regulatory and bureaucratic hurdles

How SMEs Can Prepare for Funding

- Register your business with appropriate regulatory authorities (CAC, FIRS)

- Keep organized and accurate financial records

- Develop and document a clear, investor-ready business plan

- Build a marketing and branding strategy that reflects your value proposition

- Stay updated with trends and regulations in your industry

- Review and implement internal business policies

- Integrate sustainability initiatives to appeal to impact investors

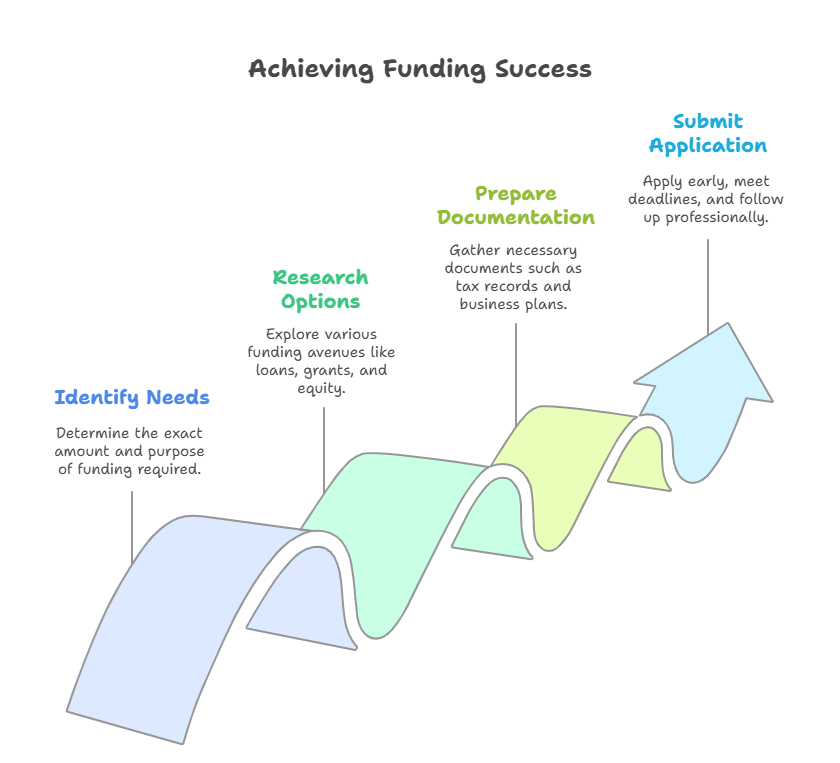

Funding Process: Four Essential Steps

- Identify Your Needs

Assess your financial requirements and define how funds will be used. - Research Funding Options

Explore which types of financing suit your business goals and risk appetite. - Prepare All Documentation

Get your CAC registration, tax IDs, financial statements, and business plans ready. - Submit Your Application

Follow each funder’s requirements and be sure to meet deadlines with complete information.

Practical Solutions for SMEs to Overcome Funding Barriers

- Explore non-traditional or alternative funding options such as microfinance and crowdfunding

- Build and maintain a healthy credit history through financial discipline

- Attend sensitization programs and financial literacy workshops

- Leverage expert guidance from business consultants and advisors

- Join business support organizations for mentorship, funding access, and training

When to Seek Business Financing

- Purchasing equipment or other business assets

- Expanding inventory or fulfilling increased orders

- Meeting short-term cash flow or working capital needs

- Launching new projects or business lines

- Accessing tax incentives through structured debt

- Restructuring or refinancing existing debts

- Fulfilling regulatory or compliance requirements

Quote from the Training

“Funding isn’t just about getting money; it’s about preparing your business to be fundable. The more ready you are, the easier funding becomes.”

— Mimi Nongo, FCA, FICBC, ACCA Affiliate

Conclusion

Accessing financing doesn’t have to be overwhelming. By understanding available options and proactively preparing your business, you can position yourself for long-term success.

The Institute of Certified Business Consultants (ICBC) remains committed to supporting SMEs through practical knowledge-sharing, such as the Lunch & Learn Series.

To learn more about SME financing opportunities or to join the next session, contact ICBC: